In decades past, the most valuable real estate in the United States was not hard to identify. Commercial real estate in traditional real estate capitals such as Washington, D.C., New York City, San Francisco and other powerhouse markets dominated the landscape. In many ways, this remains true. However, savvy investors are frequently turning to less oversaturated, less expensive markets to make their mark. This has led to a vicious cycle where many traditional real estate capitals have depreciated relative to the overall market.

To better understand why major markets have become less valuable in recent years, today we will discuss stronger markets in non-traditional areas including the Sun Belt and why the largest real estate markets in the U.S. have suffered.

Suburban Sprawl and the Rise of the Sun Belt

The Sun Belt can be considered any land in the southern third of the United States. It should be noted that the Sun Belt absolutely contains powerhouse real estate markets including Los Angeles, Atlanta, and San Francisco. Yet the largest commercial real estate growth is expected to continue in less traditional markets such as Nashville, Austin, Raleigh, Phoenix, and many others. There are a multitude of reasons for these trends, including:

- Domestic migration favors Sun Belt states. Texas, Florida, North Carolina, and Arizona are the top states for domestic migration over the past ten years. New York, California (a SunBelt state which is an exception to the rule), Illinois, New Jersey, and Ohio are at the bottom of that list.

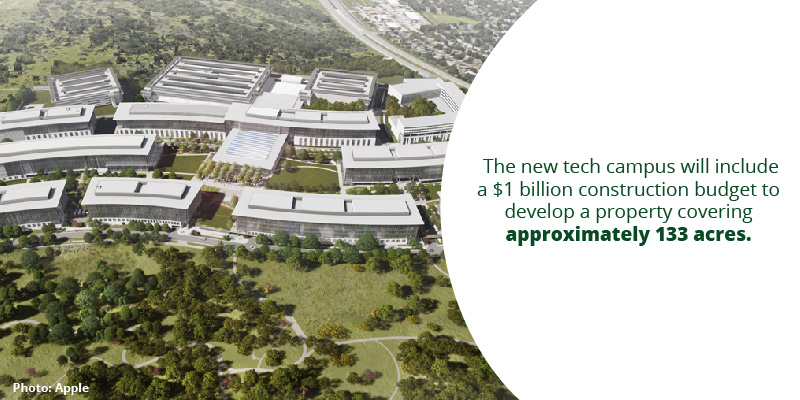

- Construction costs and living expenses are lower in many Sun Belt and other non-traditional markets. There is a reason why the largest companies on earth like Apple are choosing to build headquarters in Austin, TX instead of Silicon Valley. Costs are lower and employees are able to live more comfortably.

- Many Sun Belt states (again excluding California) have less business and real estate regulation. Fewer regulations make for easier, cheaper CRE construction projects in addition to greater flexibility for businesses.

The Largest Real Estate Markets in the U.S. Have Cooled Off

San Francisco is Experiencing High Office Vacancies

Perhaps the most notorious real estate market in the U.S., if not the world, San Francisco’s real estate booms and busts are well documented. The outrageous cost of living is driven by insanely high residential real estate values which make it virtually impossible for long time citizens to continue to rent or to purchase new homes. The commercial real estate industry is experiencing many of the same issues. Recent reports suggest that high labor costs, poor living conditions, and very high lease rates have led companies to steer clear of office space in the Bay Area.

This has extended to store front businesses as well, where less foot traffic and higher rents mean less economically viability. Unfortunately, there does not seem to be an easy fix on the horizon. All markets have their tipping point, and San Francisco appears to be on the precipice. What remains to be seen is how the city will bounce back once the real estate market normalizes.

Traditional Retail Locations in NYC are Struggling

New York is a tough market to pin down. The largest U.S. city could be considered both the healthiest or the most tumultuous real estate market in the country depending on your point of view. And NYC has always been prepared for the recent industry shift towards infrastructure and new construction mega-projects. In this way, the already densely packed city has continued to grow its already robust commercial real estate footprint.

However, the retail sector is struggling in a local economy where retail real estate is incredibly expensive and retail business models are needing to adapt to survive. Where some New York flagships survive on tourist money alone, many are closing their doors in the wake of new economic realities. This has led to many CRE properties losing their value in recent years.

Boston’s Struggling Multifamily Real Estate

9

9

Although younger renters are willing to sacrifice other amenities for ideal locations, luxury multifamily complexes in high end Boston markets are struggling. With price points too high for many young adults and many businesses opting for non-centralized locations, downtown apartment living is becoming difficult for real estate investors. The silver lining of these trends in many expensive cities is that multifamily real estate in suburban areas is increasing in popularity and value. Savvy investors may want to look to different locations to fight against the devaluation of downtown apartment living.

Going Forward

Traditional real estate capitals continue to hold a high value when it comes to commercial and noncommercial real estate. That being said, their stranglehold on the most desirable properties has lessened in recent years, giving way for less centralized office buildings and CRE multifamily units. These trends will likely continue with the caveat that major markets like New York and San Francisco will remain extremely desirable to a certain population of businesses and individuals who value urban living.