By Christpopher DeSantis, DeSantis Property Management

For the past 8-10 years, Pittsburgh PA has been experiencing an apartment building boom. Every single year since 2017, at least 2,100 new apartment units were added to the city’s existing stock, either by new constructoin or conversion of an existing building of another use. Yet despite the rash of new multifamily complexes,a recent CBRE report ranks Pittsburgh at the bottom for cities with new apartment buildings.

At the same time, CBRE also ranks Pittsburgh as #4 among the smaller tech markets in the United States. CBRE’s Scoring Tech Talent report shows that the city has bright prospects for tech industry job growth and economic impact. Factors driving the growth are cheaper apartments, shorter commutes, and affordable living costs.

The implication is that Pittsburgh will become even more attractive to workers and businesses seeking new opportunities. For property investors contemplating a new apartment complex in Pittsburgh, there could not be a better time. As DeSantis Management explains, the relative shortage of apartment buildings and impending population growth makes this a potentially highly profitable proposition.

But what would be the likely cost of such a project?

What to expect when building a multifamily complex

The biggest obstacle when building a multifamily complex is multiple cost issues. The first of which is increasing prices. Building materials prices have been going up and are likely to continue rising. But the problem of heightening costs is not limited to building materials. There are three main areas of rising expenses:

1. Regulatory compliance

The National Multifamily Housing Council (NMHC) estimates this as one of the primary costs when building a multifamily complex. Regulatory costs can take up a whopping 32% of the overall costs.

2. Construction materials

Increase in prices of building materials following the outbreak of the pandemic has been unprecedented. Along with higher costs, there is continuing scarcity of the most vital building materials.

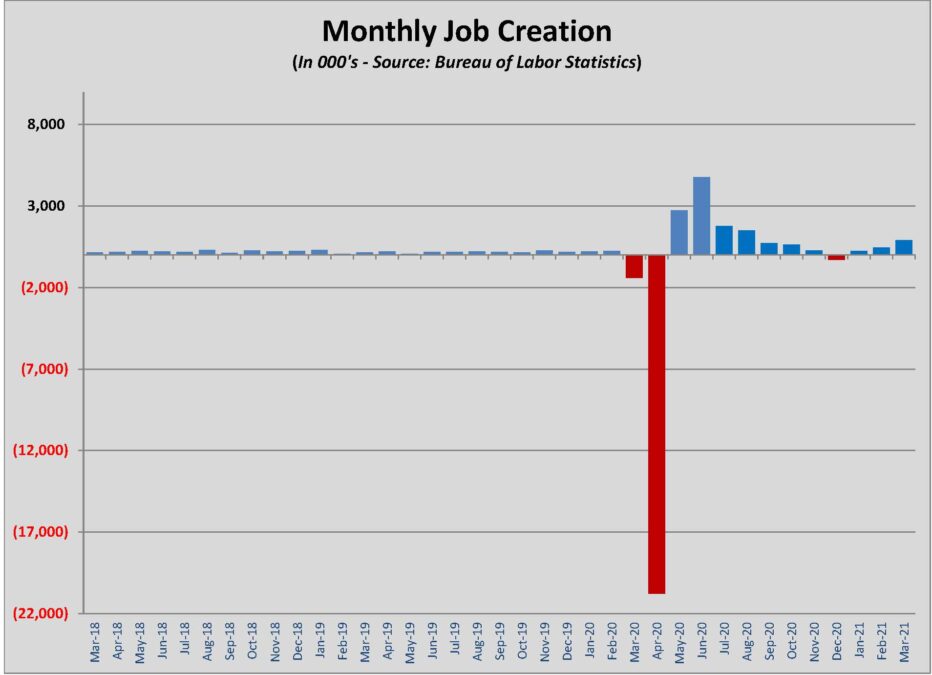

3. Surging labor cost

The construction industry has always had labor shortages. But this has been exacerbated by the mass retirement of the mostly aging labor force due to fear of Covid-19. The result is higher labor costs.

Estimating your construction costs

The other cost problem is getting an accurate estimate of construction costs. In the early stages, you want a simple guesstimate of what the project might cost you. That will usually depend on the price of similar projects in the area within the last year or two. But this costing barely provides ballpark figures which serve as a general guideline.

That initial costing helps in deciding the feasibility of the project. Once you determine that the project is within the affordable range, you need a professional construction cost estimator to create a detailed budget estimation. It is expensive but necessary; failing to do it at the start of the project could set you back tens of thousands of dollars later.

The two primary costs in a multifamily building project

Your costs for the multifamily project will be divided into hard and soft costs.

Hard costs

These have to do with the physical construction of the building. They are mainly tangibles; foundation works, roofing, landscaping, appliances, and labor costs. They do not include land acquisition costs.

Soft costs

These usually include design costs, permit fees, legal fees, loans fees and interests, and other similar expenses.

On average, you can expect hard costs and soft costs to take up 37% and 24% of your total expenditures, respectively.

Sample of a typical multifamily project construction cost

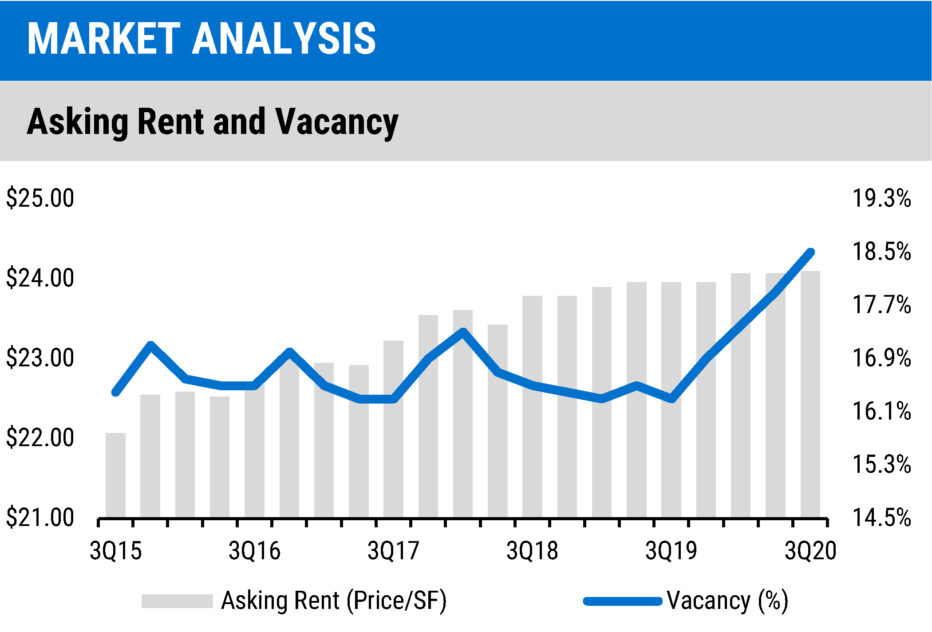

Costs for multifamily buildings are estimated per square foot, and they increase with the number of units in the building. Buildings with less than six units cost less than mid-rise buildings, which in turn are less more than high-rise buildings. Whether the project is a luxury, mid-range, or builder-grade apartment will also affect construction costs.

Construction costs do not commonly include land acquisition costs, architect fees, parking lots, landscaping, and interior design. Expenses will also vary vastly between the least and most expensive markets. Furthermore, around 15% of the building’s total square footage will be unusable spaces like lobbies, common areas, and elevator shafts.

Here is a rough guide of what your costs will be like:

· Land acquisition and, possibly, demolition costs: 19%.

· Commercial architect fees: $125 – $250 per hour.

· Contractor fees: It ranges from $85 to $200 per square foot. The average price is $125.

· Mason, excavator, and carpenter fees: $70 per hour.

· Painter’s fees: $20 – $35 per hour.

· Electrician’s fees: $65 – $85 per hour.

· Plumber’s fees: $45 – $65.

· Average cost per square foot of apartment building: $85 – $400. The average price is $229.

· Average cost per unit: $64,500 – $86,000. That includes the cost of appliances, finishing, and energy-efficient doors and windows.

Average costs per unit vary widely. In markets like San Francisco and Los Angeles, where the price per square foot is around $330 and $500 respectively, cost per unit can get as high as $352,400. In Pittsburgh, however, $75,000 per unit is a reasonable estimate.

DeSantis Property Management is a Moon Township-based manager of multi-family properties throughout metropolitan Pittsburgh.