Last week’s report on inflation seems to have triggered more fears than the report on March’s inflation, even though there was every reason to believe that prices were racing much higher as the economy raced ahead. The 4.2% jump in consumer prices (CPI) and 6.2% hike in producer prices (PPI) were remarkable only if compared to the consensus expectations for April’s inflation. The economy is bursting back open much faster than was anticipated just four months ago. The supply chain for virtually every product is disrupted and the labor force remains 3 million people smaller than the number of people working in February 2020. Soaring demand meets tight supply. That’s the simplest equation for price increases known to man. I’m not sure what model drove the lower expectations but there was runaway inflation in a handful of categories that all but assured a major (short-term) hike.

The counter argument against panicking about the April “surprise” is patience combined with capitalism. Imbalances in supply and demand exist to a greater degree than normal because of COVID-19 but those imbalances are already being addressed. Higher prices attract suppliers to increase supply and discourage consumers from purchasing. Eventually (or soon), equilibrium returns. There is a great commentary on the current inflation situation in this week’s Pensford letter. (I highly recommend subscribing if you don’t already.) Pensford distills the market pretty succinctly below:

Nearly 60% of the increase came from just five components – used cars, lodging, rental cars, airfare, and eating out. Used cars and truck prices were up a staggering 10%, comprising almost a third of the total CPI jump. That’s not sustainable over the long term. Compared to April 2019 (two years ago), inflation is up 2.2%.

More likely, we are experiencing a temporary shock of re-opening all at once, just like we experienced a temporary shock of shutting down a year ago. Remember when there was a toilet paper shortage? Demand exceeded supply. Same thing is happening now across multiple supply chains. You think Chick-Fil-A won’t figure out how to fix its shortage of sauce? These disruptions will be resolved.

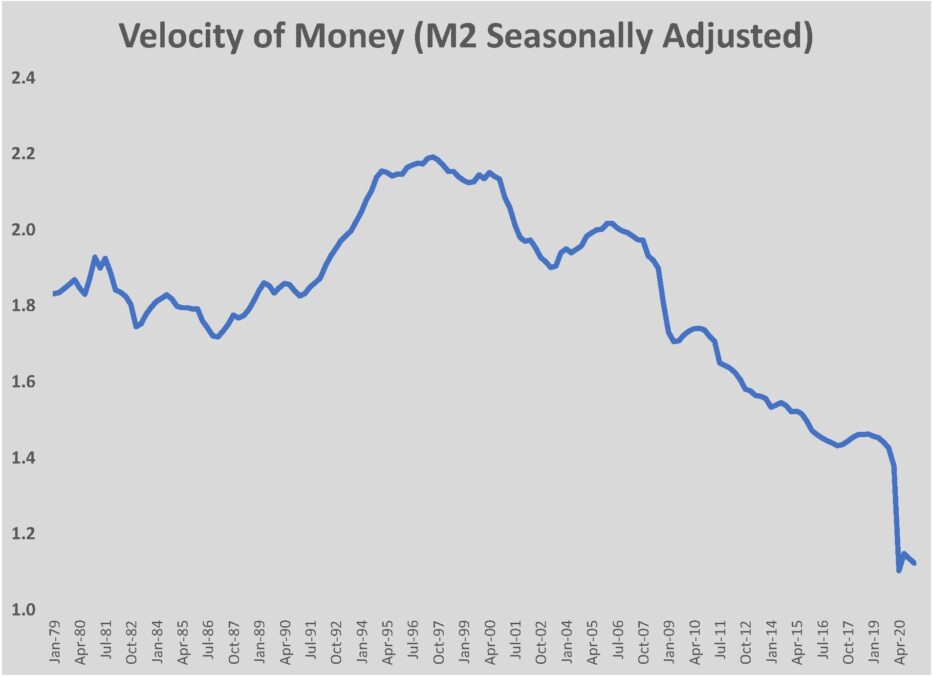

Pensford notes that a key inflationary metric, the velocity of money, is definitely pointing away from inflation. Velocity is the number of times that a dollar (or unit of currency) is used to purchase goods or services domestically. If the Federal Reserve Bank increases the supply of money by buying bonds, inflation only occurs if the money is used to buy things and drive prices up. A look at the velocity of the money supply going back 40 years shows why inflation has been trending lower even in times of increased money supply, like in the early 2010s. This trend, like the others mentioned above, doesn’t guarantee that demand won’t squeeze out supply or drive wages upward into an inflationary cycle, but absent a sharp increase in the velocity of money, equilibrium in supply and demand will bring inflation back under 2% within this year.

Probably the simplest antidote for inflation panic is to remember that April’s prices were being compared against those from April 2020, a time when there was almost no demand because we were all hunkered down at home. Consumer prices in April 2021 were 2.2% higher than those of April 2019, just to give a bit of perspective and inspire a deep breath. It is possible that the CPI next April will be lower than last month’s, but that won’t mean we’re in a deflationary cycle.

Inflation in construction is a bit more panic-worthy. the dynamics of supply and demand are consistent with what we’re seeing in consumer prices but are exaggerated because manufacturing has been recovering for nearly nine months. the change in PPI for copper year-over-year is 49%, for steel it’s 67%, for lumber it’s 85.7%, and for diesel fuel it’s 126%. Scrap prices for iron, steel, and copper range from 77% to 79% higher than April 2020. Of the dozens of categories of materials tracked by the AGC, another 14 experienced double-digit increases. But, of all these categories, only lumber seems to be in danger of a long-term, secular shift in supply. And even lumber is likely to see prices fall back again in late summer, although probably not to the $460/thousand board foot levels of September 2020. Since May 10, in fact, the price has dropped 27%.

Inflation will recede as production catches back up to demand going into 2022. In the meantime, higher prices will cause construction projects to go on hold or to be cancelled. That’s not good for an industry in recovery but that trend will also reduce demand and hasten the point of equilibrium between supply and demand. The 9.5% drop in housing starts in April is an indicator that the shortage and price of lumber is already denting new residential construction.

Construction projects moving ahead in Pittsburgh despite the higher inflation include the $22 million Clairton Wastewater Treatment Plant Phase 2, which bids July 12, and the $25 million renovation of Verizon Wireless’s Bridgeville center. Walsh Construction is the CM for Verizon Wireless. New-Belle Construction started work on the $5 million Fossil Industries new facility in Hempfield Township. Rycon Construction was the low bidder on the $11 million Rolling Hills Aquatic Center in Peters Township. Dick Building Co. was awarded the contracts for new GetGo Stores in McKeesport and McKees Rocks. MBM Contracting will be the contractor for the buildout of Goehring Rutter & Boehm’s space in 525 William Penn Place. C.H. Schwertner & Son started construction on the new Target store at the Kaufmann’s Grand on Fifth. BRIDGES & Co. is building the new $3 million Dialysis Clinic Inc. facility on Perry Highway in McCandless. Extra Storage Space selected Brackenridge Construction for its $6.5 million, 65,000 square foot expansion in Homewood.